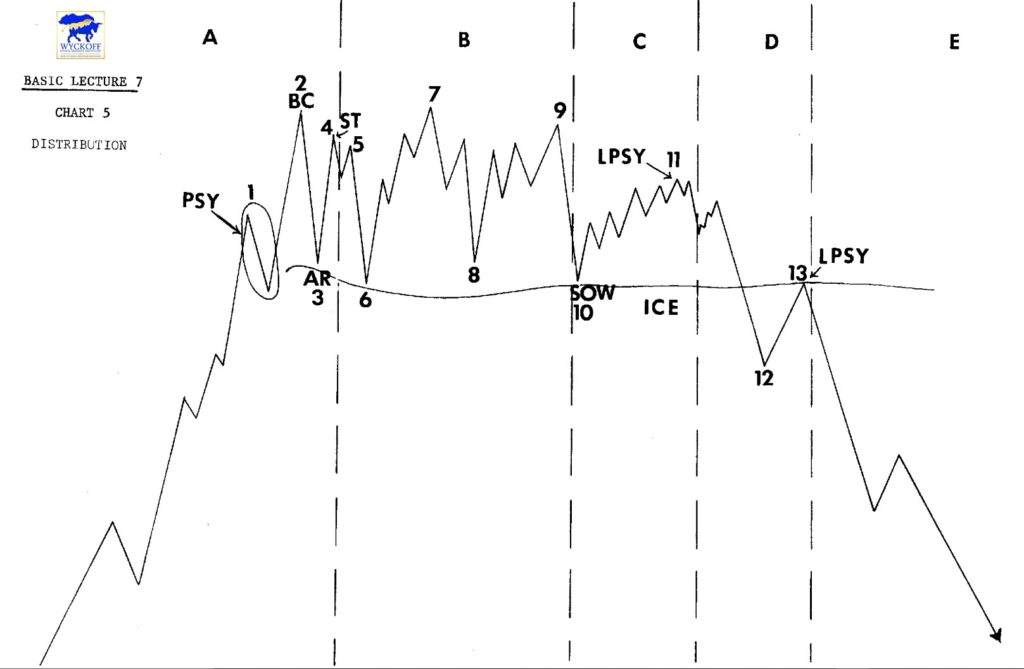

A market or an individual issue provides a Wyckoff trader with a third opportunity to establish a short position when it makes what Wyckoff traders call a rally back to the ice. In order to identify a rally back, a trader must first know what ice is. Wyckoff defines ice as a zone of values defined by the lows of reactions in a trading range. Wyckoff traders will frequently simplify this definition and equate ice with the support level of a trading range. Normally, this is acceptable. However, there can be instances where the ice is defined higher up in the trading range. The determining factor is where the low points of the various reactions in the trading range are located.

In order for there to be a rally back to the ice, the price must first provide an indication of weakness by falling through the ice. This is accomplished by wide price spreads to the down side on high or increasing volumes resulting in poor closes as the price passes through the ice. Normally, this is accomplished over several days. However, one especially bearish day can result in a fall through the ice. The Wyckoff trader wants to see the fall through the ice push the price decisively through and below the ice. This provides the price with the room needed to make a successful rally back. Traders should beware of those penetrations of an ice level that do not develop with the price spread and volume characteristics mentioned or do not decisively break the ice level. These may actually be buying opportunities.

A fall through the ice is the first step in the mark down phase. It comes after the preparation for a decline has been completed in the trading range. Therefore, the rally back is theoretically the best place to enter a short position because all of the preparation for the decline has been completed. Unfortunately, there is no mechanical way to identify exactly where the rally back is going to be completed and where the absolute best place is to open a short position. However, there are guidelines that the Wyckoff trader can use to identify a relatively narrow range of values in which to consider making a trade.

One factor to consider in identifying a spot to open a position is to consider the decline that produced the fall through the ice and where the bottom of the ice is located. Wyckoff tells us that it is normal for a reaction to be corrected by a rally equal to half of the reaction being corrected. Therefore, when the fall through the ice has been completed, the trader should identify the halfway point of the decline that produced the fall through the ice. Another important level is the bottom of the ice. When this level is combined with the halfway point of the fall through the ice, the result is a zone of values. It is in this zone where the rally back is most likely to be completed. Beware of the rally back that is able to get through this zone. If the price is able to get through the zone, it is demonstrating a level of strength that should be viewed as being incompatible with taking a short position.

A second factor to consider in identifying the spot to open a short position is the character of the price and volume action as the rally back unfolds. Wide spreads to the up side on high or increasing volumes leading to strong closes is not what the potential short seller wants to see. Action that has these characteristics indicates strength. It can result in the price rallying back through the ice and then making a significant advance. When this happens, a shakeout is said to have occurred. The Wyckoff trader wants to see a rally back that confirms the weakness demonstrated on the fall through the ice. This is accomplished with a series of price spreads to the up side that tend to narrow as the rally back progresses. If these price spreads come on decreasing volumes, the indication is of a lack of demand, which tends to confirm the weakness seen on the fall through the ice. Sometimes, there will be a surge of volume at the top of a rally back in combination with a narrow price spread. This should not discourage the short seller from considering a position. The combination of narrow spread and high volume at the top of a rally back indicates the meeting of supply and that is an indication of weakness. Supply will be needed to fuel the decline that is anticipated to follow the rally back.

When a Wyckoff trader opens a short position on a rally back, a protective stop should be placed at the same time. The trader wants to keep the stop as close as possible to the entry point to minimize the damage should the action not unfold as anticipated and the position be stopped out. However, if the stop is placed too close, it represents an invitation to be stopped out. When selecting the level at which to place the initial stop order, the trader should consider the potential profit from anticipated and the location of the ice. The stop should be placed above the ice. It should also be placed such that no more than one point is being risked for every three points of profit that is anticipated. If these two conditions are met and the entry point has been selected as suggested, the Wyckoff trader has the odds in his favor and an excellent chance of realizing a profit.