Reaction Continues

Wednesday, March 8, 2017

What To Do?

Short Term

Short-term bears should stand aside or stay short stocks with relative weakness. We are continuing to hold some shorts as there is many stocks showing relative weakness.

Short-term bulls should stand aside.

Intermediate & Long Term:

Intermediate and long term positions to the upside should be maintained.

There are no intermediate or long term opportunities to the downside.

Market Trends:

Intra-day: Down

Short Term: Up

Intermediate Term: Up

Long Term: Neutral

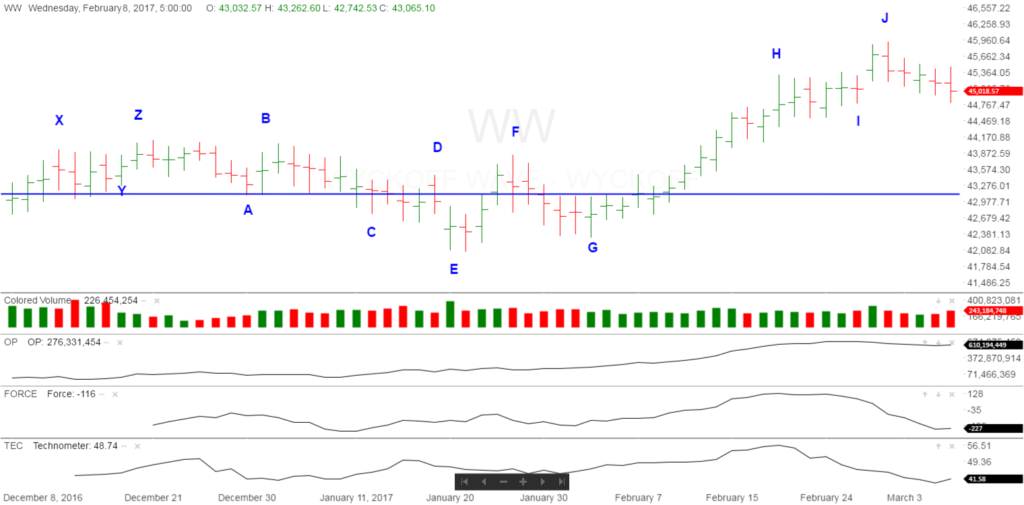

The stock market, as measured by the Wyckoff Wave opened flat, tried to rally for the early part of the day, before giving way to a late day selloff. Price and volume continue to show supply present.

The Technometer is trading slightly below neutral.

The Nasdaq was unchanged today, while the S & P was down .25%.

A review of the intra-day waves shows the Wave opening unchanged, trying to rally to erase some of the previous days losses, before selling came in late to drive the Wave to the low of the day. The O-P has continued to stair step lower as well.

The Force Index closed slightly higher today, but has been in steep downtrend for the last two weeks of trading.

On Thursday, the Technometer will open slightly below a neutral reading.

Today we continued to give back some of last weeks strong gains. The O-P and Force has continued to show weakness here so we should still see more correction. The Technometer is not yet oversold so it should allows us more downside in the days ahead as well.

Bonds were down again today and stopped us out for small losses. We are going to stand aside till the picture clears.

Good Trading,

Todd Butterfield

Responses