The Wave Quietly Trading At Top Of Range….

IMPORTANT ANNOUNCEMENT: Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is offered at an affordable $249.99 and we have had 446 new students enroll in the last 10 weeks.

We also have a Youtube channel that has grown quickly to 10,000 subscribers in a matter of a few months. If you are interested in Cryptocurrency news and Wyckoff chart analysis, search “CRYPTO NEWS”, subscribe, and click the bell to be notified of our upcoming broadcasts. Our current schedule is Monday-Friday around 5 p.m. CST and they usually last close to two hours, and we just added an approximate 10-11 a.m. broadcast to reach more of our international subscribers. We have subscribers all over the world, so at times we vary broadcasts to try and satisfy international subscribers.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter. We felt this market with its public participation, lots of volatility, and extreme emotions would be much easier to trade. So far that has been the case…

***Our Wyckoff Wave chart is still having corrupted data. We apologize for the continued issue. Our developers are trying to fix issue….

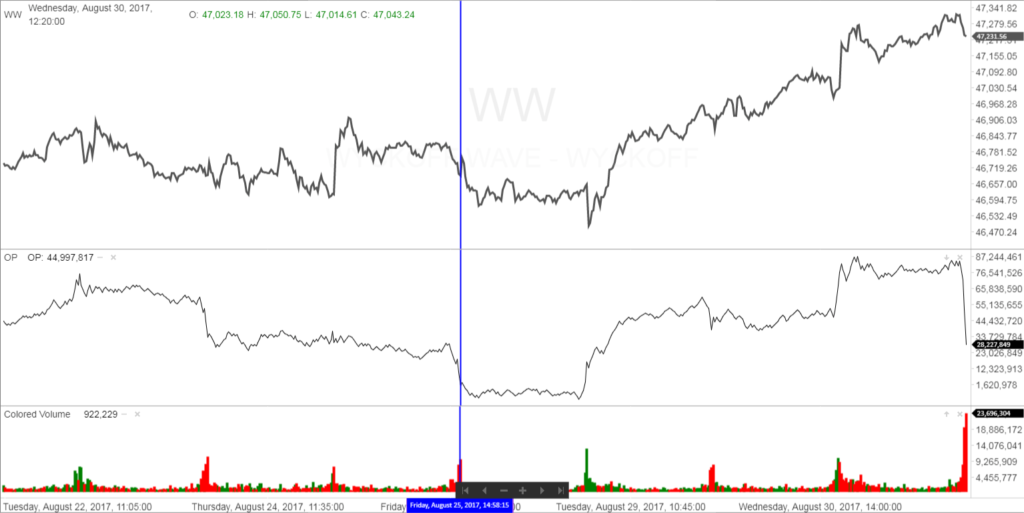

This past week the Wyckoff Wave traded in a narrow range at the top of the recent range. We had expected the Wave to continue trading in the narrow range, after being disappointed we didn’t start a markup phase after what looked like a successful backup on a short term basis. No acceleration higher where we would have expected it, so we feel we are trading range bound. For the week, price and volume gave no strong clues.

The Technometer is slightly below neutral.

The S&P and Nasdaq were both unchanged for the week.

The Wave spent the week trading in a narrow range with no new information. The O-P fell sharply into the close Friday before the weekend.

The O-P continues to trade weaker than the Wave, and closed slightly higher for the week.

The Force Index was higher for the week.

** LONGER TERM CHART IS NORMALLY HERE**

The Wyckoff Wave Growth Index (WWG) once again experienced a correction for the week. We had expected a turn lower here due to the extreme overbought Technometer. After last weeks selloff, the Technometer has now came back to register a neutral reading. We have been bearish this market, and stay bearish.

The bond market continues to rally further back into the recent uptrend. The Technometer is extreme overbought and we still expect this market to experience a correction. The O-P is rallying with the TLT, but the Force has now lagged the last few weeks.

Good Trading,

Todd Butterfield

Responses