The Wyckoff Wave Continues its Rally

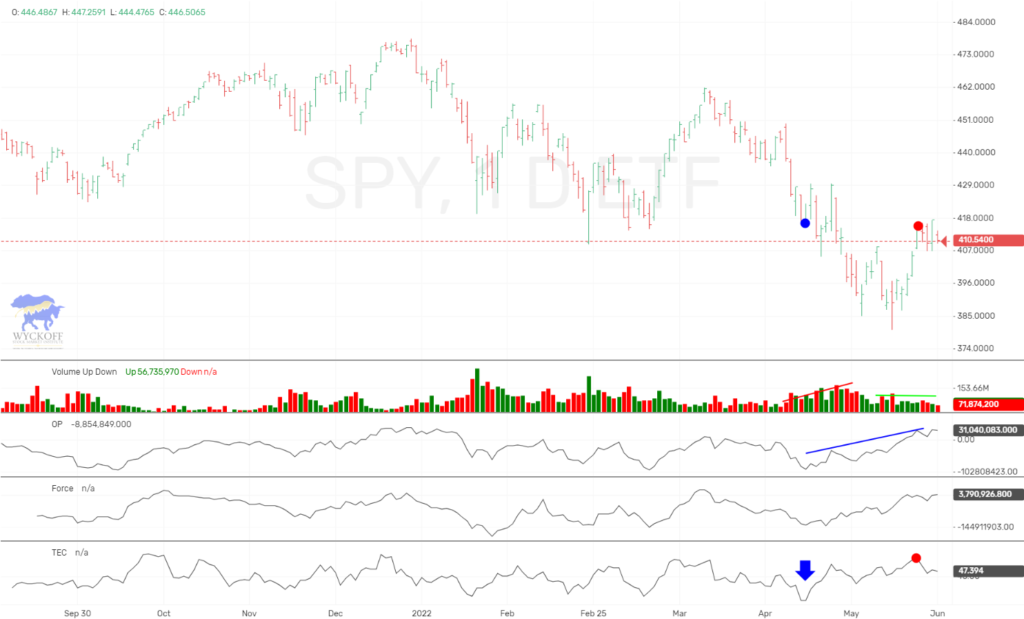

This past week the Wyckoff Wave traded sharply higher again. Volume was at average levels of recent weeks.

The Technometer is trading slightly above neutral, after reaching overbought a week ago.

For the week the S&P was up 1.57%, and the Nasdaq 1.75%.

The Wave spent the week adding to previous weeks gains.

The O-P has returned to new highs as well erasing the divergence we spoke of on last update. A divergence which has price leading and the O-P trailing is not as reliable as the opposite, with O-P leading and price lagging.

The Force Index continues to show some relative weakness and inharmonious action.

The Technometer began the week near an overbought reading, but finished the week off of extreme levels.

The one year daily chart shows the Wyckoff Wave now trading above all trendlines as well as the accelerated one we show in purple. This is extremely strong price activity. We have had the Wave close 9 straight days higher than the opening.

We have been looking for a correction and their are many sentiment reading at 30+ year extremes. It feels we are in need of a breather but we can currently give no signs from our work to say it is now.

The Wyckoff Wave Growth Index (WWG) also poked its head out of its recent uptrend channel. It to was overbought early in the week and still trading near overbought levels. Two weeks ago we had an oversold Technometer and we thought that needed to be relieved which has now occurred. Once again we think we could use a breather here, but the only indicator backing up that opinion is the Technometer.

The bond market traded slightly lower last week. The rally two weeks ago was not supported by the OP and Force which lead to the selling into last Wednesdays low. The Technometer just registered overbought so we expect this market to continue to work lower in the days ahead.

IMPORTANT ANNOUNCEMENT: This week we will be launching our “Pulse of The Market” for Cryptocurrrencies. This software will have consolidated volume for the Crypto’s which will be most important when applying Technical Analysis.

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is now being offered at an affordable $299.99. We have had 859 students enroll in the last 26 weeks.

If you are interested in Cryptocurrency news and Wyckoff chart analysis, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCu_6nOA9sC0GTbaSWi3nBSw/featured?view_as=public .

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday around 6:30 p.m. CST and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses