The Wyckoff Wave Continuing to Trade in a Narrow Range

We had a holiday sale on our Cryptocurrency and Wyckoff Course at LearnCrypto.io Use code “Thanksgiving” at checkout to receive $100 off to reduce it to an affordable $199. This sale lasts till Monday night, and the last chance to get this excellent course before a price increase.

Students can also get our soon to release “Pulse of the Market” software for Crypto’s at half price versus non students. So enroll now!!

We also have 20% off our Wyckoff offerings so an excellent time to make a purchase. Use code “BlackFriday” at Wyckoffsmi.com

This past week the Wyckoff Wave experienced another small gain. Volume trailed off in light holiday trading.

The Technometer is trading at a neutral level.

For the week the S&P was up .93%, and the Nasdaq up 2.2%.

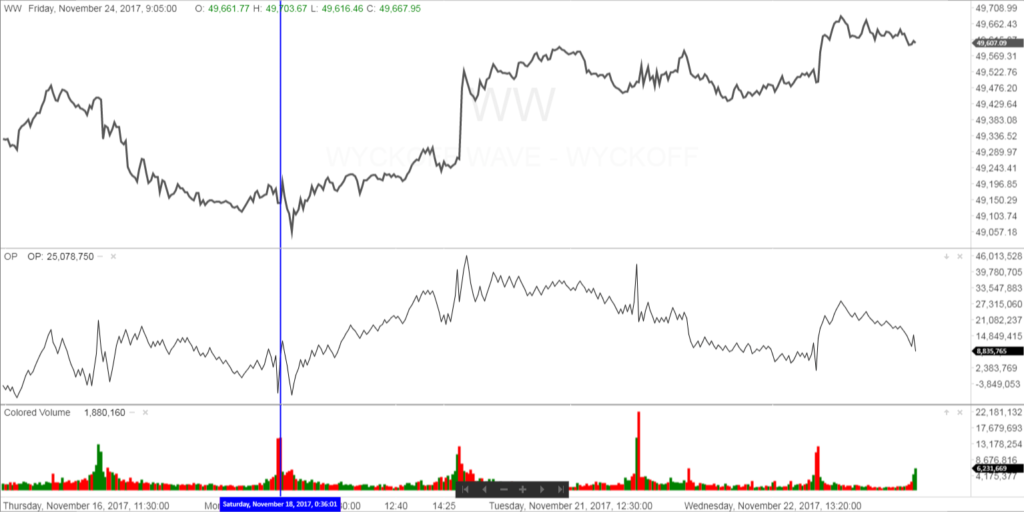

The Wave spent the week rallying slowly to the upside. After springing the bottom of the recent trading range, we did not get a obvious test unless it was early Monday. But the rally since then has been uninspiring, so possibly we can get a better test this week. The O-P traded falt for the week with no commitments taken on the holiday shortened week.

The Force Index was also up slightl for the week.

The Technometer began the week slightly above a neutral reading, and finished the week at a neutral reading. Not much help here from the Technometer.

The one year Daily chart shows the Wyckoff Wave still in the upper portion of the recent uptrend chanel. We have expected more downside but so far have not received it.

The Wyckoff Wave Growth Index (WWG) had a nice rally for the week and is going for the upper boundary of the intermediate term uptrend. We was looking for a more pronounced test of the creek, but it appears we are read to move higher with the test complete.

As we had mentioned previous, it appears this market wants to visit its overbought line of the recent uptrend marked in blue. The Technometer here is also trading near neutral, so it should allow this market to work higher to resistance.

The bond market ended the week only slightly higher and the Technometer is now back to overbought. We are at previous resistance and a good spot to add to shorts. Look for a move back into the middle of the recent range marked in light blue.

IMPORTANT ANNOUNCEMENT: We will be launching our “Pulse of The Market” for Cryptocurrrencies very shortly. This software will have consolidated volume for the Crypto’s which will be most important when applying Technical Analysis.

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is offered at an affordable $299.99 and we have had 700 new students enroll in the last 2a weeks.

We also have a Youtube channel that has now grown quickly to 13,000 subscribers in a matter of a few months. If you are interested in Cryptocurrency news and Wyckoff chart analysis, search “CRYPTO NEWS”, subscribe, and click the bell to be notified of our upcoming broadcasts. Our current schedule is Monday-Friday around 6 p.m. CST and they usually last close to two hours, and we just added an approximate 11-12 a.m. broadcast to reach more of our international subscribers. We have subscribers all over the world, so at times we vary broadcasts to try and satisfy international subscribers.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses