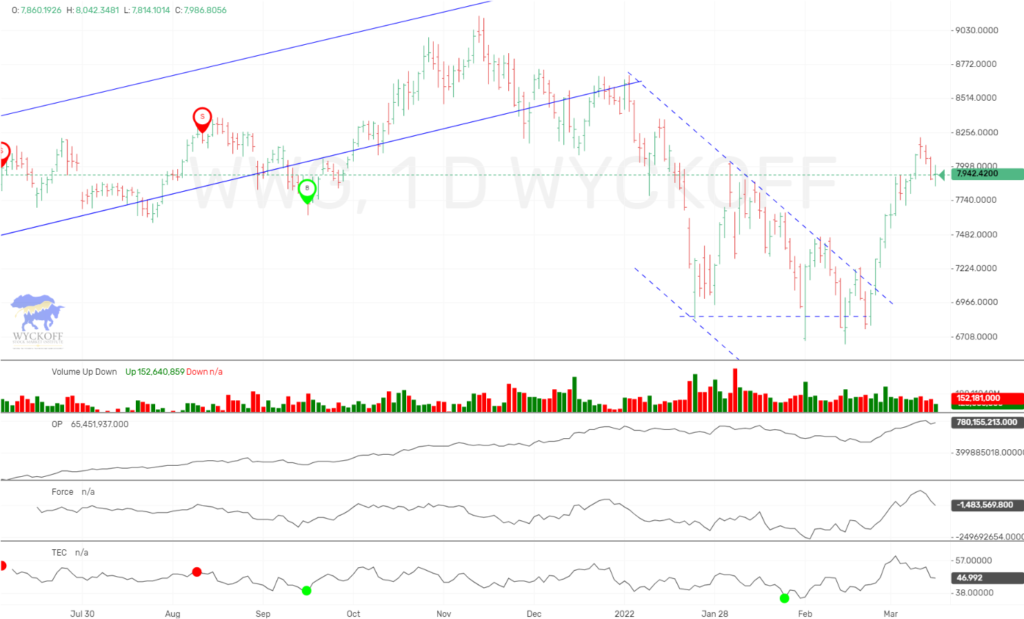

The Wyckoff Wave still trading near overbought line of uptrend…

WE ARE CONTINUING TO HAVE CHARTING ISSUES. WE NORMALLY RELEASE THESE “WEEK IN REVIEWS” ON SUNDAY EVENINGS. HOPEFULLY WE WILL GET BACK TO NORMAL SCHEDULE.

The Wyckoff Wave has continued to try and reach the overbought line of the recent uptrend as mentioned on our last update. Volume has been average to slightly lower on this rally.

The recent action still appears positive. Anymore selloff in the Wave and the Technometer will probably once again become oversold. This will give us another opportunity to rally.

The O-P was slightly weaker than the Wave on last weeks rally and gave us a small bearish divergence.

The Force Index has also under performed on the recent rally.

The Technometer did reach near overbought 5 trading sessions ago, but now is back to below neutral readings and close to oversold.

The intraday chart shows the under performance of the OP on the recent rally versus the Wyckoff Wave (WW). This had occured with the near overbought reading of the Technometer. These factors have lead to the last few days corrective action.

The one year daily chart shows the Wyckoff Wave trading in an uptrend on an intermediate term basis. With the Technometer once again nearing an oversold reading, I would expect the Wave to try and rally back to the purple resistance line in the near future.

The Wyckoff Wave Growth Index (WWG) continues to rally. It is also trading near its overbought line of its recent uptrend, but appears to continue to be able to trade higher. Its Technometer reading is at 47, and leaves more upside available.

The bond market is trading sideways after its recent upthrust. Its Technometer is overbought but we do not see a low risk entry at this time. We will be on the sidelines…

IMPORTANT ANNOUNCEMENT: We will soon be launching our “Pulse of The Market” for Cryptocurrrencies. This software will have consolidated volume for the Crypto’s which will be most important when applying Technical Analysis. We have had delays in the launch as we are now trying to bring in volume from 89 exchanges.

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 926 students enroll since its launch on June 22, 2017.

If you are interested in Cryptocurrency news and Wyckoff chart analysis, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday approximately 6:30 p.m. CST, and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses